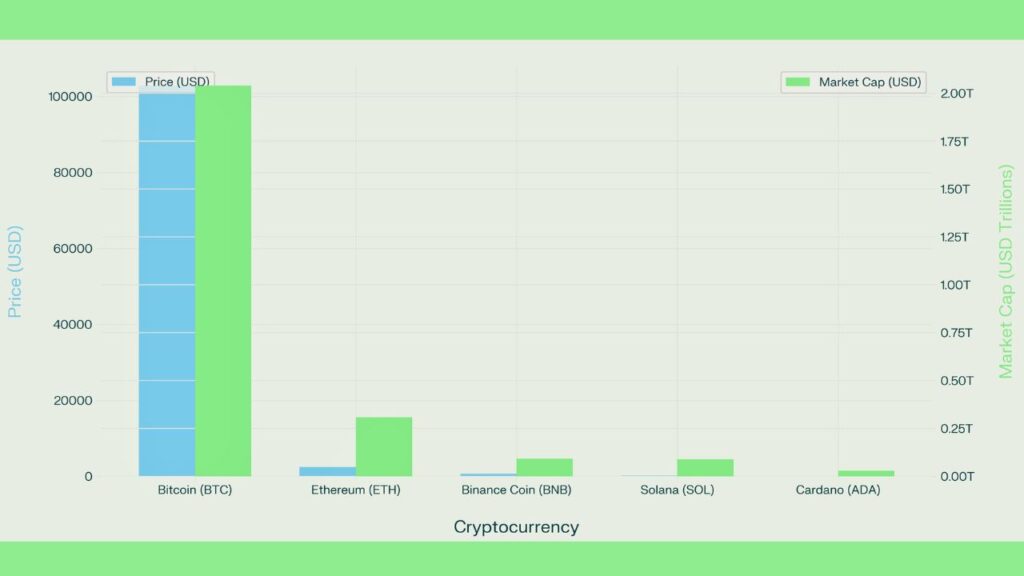

The cryptocurrency market has been moving up and down recently, and interest is expected to increase around early 2025. Currently, Bitcoin is priced at approximately $102,000 (market cap $2.04 trillion) and Ethereum sits at roughly $2,500 ($298 billion). We will discuss five coins, including Bitcoin, Ethereum, Binance Coin (BNB), Solana, and Cardano, considering their unique features and pros and cons at their current prices. Always conduct your research before investing, as the U.S. regulatory policies are changing, and things can still shift.

1. Bitcoin (BTC)

Touted as the granddaddy of all digital currencies, Bitcoin is known as “digital gold” for its decentralized features and blockchain technology. Its trading value is around $102k as of May 2025, with a market cap slightly more than $2.0 trillion. The performance of Bitcoin has also been strong as it peaked around $105k in May, following a ~$75k slump in April. The price rise was triggered by the U.S. Bitcoin ETFs dramatically increasing their coin purchases YTD and the 2024 halving. Even more positive are the Bitcoin-friendly rules being passed in several U.S states, which encourage businesses to adopt it as a mode of payment.

Use case: One of Bitcoin’s primary functions is to act as a store of value and hedge against inflation. Nowadays, Bitcoin is more focused on digital payments, with the Lightning Network allowing speedy transfers.

Pros:

The most recognized brand name in the business, along with ease of liquidity, acceptance of Bitcoin in various places such as wallets, ATMs, and other ETFs offers a hard supply cap which provides scarcity value, and deflationary.

Cons:

The cons are energy consumption concerns (though new miners and tech mitigate this), still volatile price changes, Bitcoin can serve only as a payment or store of value, and smart contracts cannot be utilized.

2. Ethereum (ETH)

Ethereum continues to hold the position as the most dominant innovative contract platform. The price sits between 2400 and 2600, with a market cap of nearly 298 billion dollars. ETH powered the 2020s DeFi and NFT booms, and remains the most used blockchain for dApps. The proof-of-stake upgrade has decreased energy expenditure. Furthermore, a crucial upgrade is planned for 2025, which will improve scalability and usability. Ethereum was also predicted to rebound after a price dip in April 2025.

Recent updates: ETH is trading above 2600 and sometimes becomes deflationary because a portion is burned during transactions.

Use cases: Building block for stablecoins, decentralized applications such as DeFi, NFTs, DAOs, and other Web 3.0 functionalities.

Pros: Advanced ecosystems of applications; the pioneering player in smart contracts; reduced fee barriers through competing upgrades; the center of attention with ever-deflationary tokenomics.

Cons: Still significantly high, facing competition from rising blockchain producers, rough patch price performance, or other utility-focused blockchains.

3. Binance Coin (BNB)

Binance Coin (BNB) is a token in the Binance ecosystem (the exchange and the BNB Smart Chain). It’s priced at approximately $650 and has a market cap of about $92 billion. Two primary functions of BNB include paying transaction costs on Binance Exchange and fueling transactions on the BNB Chain. More recently, developments such as the major hard fork on the BNB chain and the quarterly burn of BNB have continued to sustain momentum.

Use Case: an ecosystem token for Binance with primary functions for exchange and stake and the native asset for BNB Smart Chain, which supports DeFi, NFTs, and Lite payments.

Pros:

The pros include robust support from the exchange and lower-budget competitors, consistent burn events that add deflationary mechanics and reduce circulating supply, and high adoption of DeFi services on BNB Chain.

Cons:

The cons are the strong dependency on Binance’s influence (adverse regulatory actions directed at the exchange would negatively impact BNB), the lack of decentralization, and the recent price stagnation.

4. Solana (SOL)

Solana is a fast Layer-1 blockchain with an approximate price of $172 and a market cap of $89 billion. Its rapid transaction speeds and low transaction fees characterize it. After battling with outages in the past, Solana surged in 2025 due to the tokenization of real-world assets and expanding apps like DeFi, gaming, and NFTs. Partnerships are also very common. For example, Solana partnered with Visa and Shopify so merchants can accept payments in SOL.

Use Case: Mobile payments, DeFi and NFT platforms, fast trading, and payments.

Pros:

Strong institutional sentiment, booming developer ecosystem, extremely fast and cheap.

Cons:

More centralized, younger network, and past instability have made some more cautious.

5. Cardano (ADA)

Cardano (ADA) is a smart-contract blockchain focused on research-led development. With a current price of $0.83 and a market cap of $29.4 billion, ADA is making significant strides. Always focusing on sustainability and an environmentally friendly approach, Cardano includes rigorous academic research. Its core features in 2025 include a layer-2 scaling solution and ongoing governance enhancements aimed at improving network activity and developer participation.

Use Case: Smart contracts for government and blockchain projects, decentralized finance, and more energy-efficient options.

Pros:

Steady improvements in development, robust community support, and energy efficiency.

Cons:

The cons are the reduced number of applications compared to Ethereum and Solana, the slower rollout, and the price trailing behind the market.

Comparison Table

| Crypto | Price (May 2025) | Market Cap | Key Features/Use-Cases | Pros | Cons |

|---|---|---|---|---|---|

| Bitcoin (BTC) | ~$102,875 | $2.04 T | Digital gold, store-of-value, P2P payments | Widely accepted; capped supply | Volatile; no smart contracts |

| Ethereum (ETH) | ~$2,468 | $298 B | Smart contracts, DeFi, NFTs | Largest dApp ecosystem; burn mechanism | High fees; steep competition |

| Binance Coin (BNB) | ~$650 | $91.6 B | Exchange token, BNB Chain | Strong Binance backing; regular token burns | Linked to Binance; regulatory risk |

| Solana (SOL) | ~$172 | $89.2 B | High-speed L1 (DeFi, gaming) | Fast/cheap; growing ecosystem | Less decentralized; past outages |

| Cardano (ADA) | ~$0.83 | $29.4 B | PoS platform, gov’t use | Energy-efficient PoS; scalability focus | Slower dev cycle; fewer dApps |

The flavor proffered by these coins is distinct. Bitcoin is for stability, Ethereum is for decentralized applications, BNB is for the Binance universe, Solana is for high-speed innovation, and Cardano is for long-term R&D. The U.S. regulatory climate is cautiously improving, but look out for new rules.

Remember to consider the advantages and disadvantages, and only put money in that you can afford to lose.

Key Takeaways

Bitcoin: Functions as digital gold; conservative crypto exposure.

Ethereum: Leading smart-contract platform with major updates planned for 2025.

Binance Coin: Powers Binance’s exchange and smart chain.

Solana: Fast transactions and expanding partnerships.

Cardano: Focuses on research and platform scalability.

Every crypto asset is designed with a specific investor in mind.

Make sure to think about your goals and risk tolerance before making any moves.

You may read this: Low-Cost ESG ETFs with High Returns: A 2025 Guide for U.S. Investors